More About Cfo Company Vancouver

Wiki Article

Small Business Accountant Vancouver - An Overview

Table of ContentsThe 7-Minute Rule for Small Business Accounting Service In VancouverThe Greatest Guide To Vancouver Accounting FirmThe 10-Second Trick For Vancouver Tax Accounting CompanyThe Definitive Guide for Cfo Company VancouverLittle Known Questions About Cfo Company Vancouver.The Main Principles Of Small Business Accounting Service In Vancouver

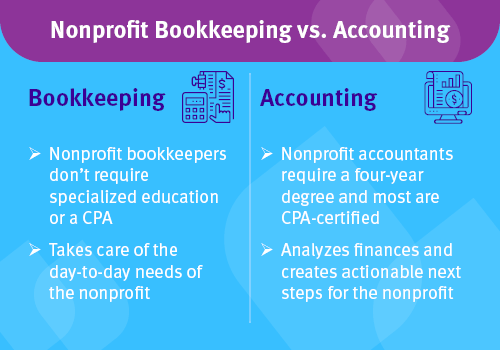

Here are some benefits to hiring an accounting professional over an accountant: An accountant can give you a thorough sight of your service's financial state, together with techniques and recommendations for making financial choices. On the other hand, bookkeepers are just in charge of tape-recording financial deals. Accounting professionals are called for to finish more education, certifications and job experience than accountants.

It can be tough to assess the ideal time to employ a bookkeeping expert or bookkeeper or to determine if you require one in any way. While several small companies employ an accountant as a professional, you have numerous choices for managing financial jobs. Some tiny service proprietors do their own accounting on software their accounting professional recommends or utilizes, providing it to the accounting professional on a regular, month-to-month or quarterly basis for activity.

It may take some history research to find an appropriate accountant since, unlike accounting professionals, they are not needed to hold an expert qualification. A strong recommendation from a relied on colleague or years of experience are necessary elements when employing an accountant. Are you still unsure if you require to work with somebody to assist with your books? Right here are three circumstances that suggest it's time to hire an economic specialist: If your taxes have ended up being also complex to handle by yourself, with numerous revenue streams, foreign investments, several deductions or other factors to consider, it's time to employ an accounting professional.

The smart Trick of Small Business Accounting Service In Vancouver That Nobody is Discussing

:max_bytes(150000):strip_icc()/accountingmethod_definition_final_primary-resized-005e466f5d72435fbf101c5e671b1ad5.jpg)

For small companies, skilled money administration is an essential aspect of survival and growth, so it's a good idea to deal with a monetary professional from the start. If you prefer to go it alone, take into consideration beginning out with bookkeeping software application and also maintaining your books thoroughly as much as date. That means, should you need to hire a professional down the line, they will certainly have exposure into the total monetary history of your business.

Some source interviews were small business accounting service in Vancouver carried out for a previous variation of this short article.

Get This Report on Tax Consultant Vancouver

When it pertains to the ins and also outs of tax obligations, accounting and financing, nonetheless, it never ever injures to have an experienced professional to turn to for assistance. An expanding variety of accountants are also dealing with points such as capital estimates, invoicing and also HR. Ultimately, a number of them are handling CFO-like functions.Local business proprietors can anticipate their accountants to assist with: Picking business structure that's right for you is essential. It affects how much you pay in tax obligations, the paperwork you need to submit as well as your personal obligation. If you're aiming to transform to a different service structure, it can lead to tax obligation repercussions and various other complications.

Even companies that coincide dimension as well as market pay really various amounts for audit. Prior to we get right into buck figures, let's talk regarding the expenditures that go right into small company audit. Overhead costs are expenses that do not directly transform right into a revenue. These expenses do not convert right into cash money, they are essential for running your business.

Not known Details About Pivot Advantage Accounting And Advisory Inc. In Vancouver

The average expense of accounting services for little organization differs for each and every distinct circumstance. Yet because bookkeepers do less-involved tasks, their prices are usually less costly than accounting professionals. Your monetary service charge relies on the job you require to be done. The average regular monthly accountancy costs for a small service will certainly climb as you include extra solutions as well as the tasks get more difficult.You can tape-record purchases and process pay-roll making use of on-line software. Software services come in all forms and also sizes.

Small Business Accounting Service In Vancouver Fundamentals Explained

If you're a new entrepreneur, don't neglect to variable accountancy prices right into your spending plan. If you're a veteran owner, it may be time to re-evaluate audit costs. Management costs as well as accounting professional fees aren't the only audit costs. Vancouver accounting firm. You should likewise take into consideration the results accounting will carry you as well as your time.Your ability to lead workers, serve customers, and choose can suffer. Your time is also important and also must be taken into consideration when looking at bookkeeping expenses. The time spent on accounting jobs does not create earnings. The less time you invest on bookkeeping as well as tax obligations, the more time you have to grow your business.

This is not intended as legal suggestions; to find out more, please click on this link..

The Definitive Guide to Tax Accountant In Vancouver, Bc

Report this wiki page